FROM COAST TO COAST, DAILY TO CATASTROPHIC EVENTS,

WE’VE GOT FLORIDA & THE UNITED STATES COVERED!

Our highly trained adjusters will work with you to bring closure to your claim as quickly and efficiently as possible. Our dedication and preparation for handling minor to large disasters is unparalleled. WITH GILES INSURANCE ADJUSTING, YOU’RE IN SURE HANDS!

OUR COMPANY

Giles Insurance Adjusting is based in Tampa, Florida. We employ a vast network of expert, multi- line adjusters able to be deployed within 72 hours to any disaster area. When insured losses occur, carriers and policyholders expect immediate access to skilled support services. Giles Insurance Adjusting secures each client’s confidence in surpassing that demand with the rapid response of our adjusters who are experienced in policy coverage and estimating. We are committed to providing superior customer service, delivering a quality product and exceeding our client’s expectations.

CORE FUNCTION

Our Management Team is a key asset necessary to continue to propel our company into the future. Combined, GIA’s management team has over 125 years of direct experience in insurance, general management and operations. Our highly experienced Management Team is made up of very diverse backgrounds, including Veterans of the United States Armed Forces. Our knowledge and experience of the insurance industry allows Giles Insurance Adjusting to manage claims as a Third Party Administrator.

The strength of our Team stems from three major factors: KNOWLEDGE, INTEGRITY & TEAM WORK. Our Team knows that to maintain success, all three aspects must be incorporated in daily operation. We have and will continue to incorporate these standards in our process of doing business.

Capabilities & Expertise

Catastrophe

Non-Catastrophe

Property & Casualty

Underwriting Inspection

Flood

Residential

Commercial

Boat

Personal Property

General Liability

Mediation

Litigation

(See Capability Statement for full list)

Why Team Giles?

+ Our Management team has 125+ years of direct experience in insurance and general management.

+ Our Team is made up of very diverse backgrounds, including Veterans of the United States Armed Forces.

+ Full or partial TPA services available

+ 500+ expert, multi-line Adjusters Nationwide

+ Our in-house training guarantees quality

assurance of client’s requirements

+ Our field training provided by our Managers and Trainers ensure clean and accurate claim handling

+ Rapid Response Deployment available Nationwide

+ Emergency + After-hours Call Center

+ Superior Customer & Client Service

Licenses & Certifications

Minority Business Enterprise

Florida Business Enterprise

LEED Accredited Professional

Linguist Certified - Various Languages

FEMA Industry Liaison Program

NFIP Certified

State Farm Certified - Property & Auto

Nationwide Certified

Citizens of Florida Certified

NICTA

HAAG

California Earthquake Authority

Rope & Harness Certified

DID YOU KNOW

Be informed with the facts!-

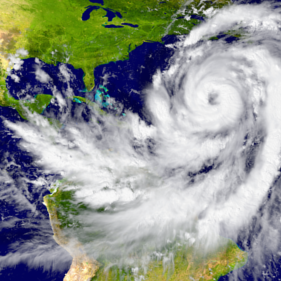

ATLANTIC HURRICANE

PATH PROJECTION- From 2005 to 2014, total flood insurance claims averaged more than $3.5 billion per year. (Source: www.floodsmart.gov)

- The costliest hurricane, based on insured property losses to Florida, was 1992’s Hurricane Andrew. It caused $23.4 billion in damage to Florida and Louisiana in 1992 (in 2013 dollars). (Source: Insurance Information Institute)

- From 2005 to 2014, total flood insurance claims averaged more than $3.5 billion per year. (Source: www.floodsmart.gov)

-

Apartment Complex

roof damage- Hail causes about $1 billion dollars in damage to crops and property each year, according to the National Oceanic Atmospheric Administration (NOAA). (Source: http://www.iii.org/)

- Seven of the 10 costliest hurricanes in U.S. history have impacted Florida. Six of these storms occurred within just two years: 2004 and 2005. (Source: Insurance Information Institute)

- About one in 30 insured homes has a property damage claim related to wind or hail each year. (Source: Insurance Information Institute)

- Hail causes about $1 billion dollars in damage to crops and property each year, according to the National Oceanic Atmospheric Administration (NOAA). (Source: http://www.iii.org/)

-

Tornado

DESTRUCTION PATH- The U.S. experiences more tornadoes than any other country, according to a 2013 report by Lloyd’s of London. (Source: http://www.iii.org/)

- Tornadoes accounted for 39.1 percent of insured catastrophe losses from 1995 to 2014, according to Verisk’s Property Claim Services (PCS). In 2014 insured losses from U.S. tornadoes/thunderstorms totaled $12.3 billion, up from $10.3 billion in 2013. 2014 losses were the fourth highest annual total on record, according to Munich Re. (Source: http://www.iii.org/)

- The U.S. experiences more tornadoes than any other country, according to a 2013 report by Lloyd’s of London. (Source: http://www.iii.org/)

-

WATERFRONT CONDOS

HURRICANE AFTERMATH- Hurricanes, winter storms and snowmelt are common (but often overlooked) causes of flooding. (Source: www.floodsmart.gov)

- Federal disaster assistance is usually a loan that must be paid back with interest. For a $50,000 loan at 4% interest, your monthly payment would be around $240 a month ($2,880 a year) for 30 years. Compare that to a $100,000 flood insurance premium, which is about $400 a year ($33 a month). (Source: www.floodsmart.gov)

- Just a few inches of water from a flood can cause tens of thousands of dollars in damage. (Source: www.floodsmart.gov)

- Hurricanes, winter storms and snowmelt are common (but often overlooked) causes of flooding. (Source: www.floodsmart.gov)

-

TROPICAL STORM

- Florida accounted for 14 percent of all U.S. insured catastrophe losses from 1983 to 2013: $66.8 billion out of $478.4 billion, based on data from the PCS division of ISO. (Adjusted for inflation by ISO using the GDP implicit price deflator.) (Source: Insurance Information Institute)

- Florida leads the nation in the number of flood policies, according to the National Flood Insurance Program, with about 2.0 million policies in force in 2013. Standard homeowners policies typically do not cover flood damage. Flood insurance is covered by the National Flood Insurance Program. (Source: Insurance Information Institute)

- Florida accounted for 14 percent of all U.S. insured catastrophe losses from 1983 to 2013: $66.8 billion out of $478.4 billion, based on data from the PCS division of ISO. (Adjusted for inflation by ISO using the GDP implicit price deflator.) (Source: Insurance Information Institute)

-

COMMERCIAL BUILDING

ADJUSTER INSPECTION- In the past 5 years, all 50 states have experienced floods or flash floods. (Source: www.floodsmart.gov)

- New land development can increase flood risk, especially if the construction changes natural runoff paths. (Source: www.floodsmart.gov)

- Events involving wind, hail or flood accounted for $21.4 billion in insured catastrophe losses in 2014 dollars from 1994 to 2014 (not including payouts from the National Flood Insurance Program), according to Property Claim Services. (Source: http://www.iii.org/)

- In the past 5 years, all 50 states have experienced floods or flash floods. (Source: www.floodsmart.gov)

-

Kitchen

water damage- About one in 55 insured homes has a property damage claim caused by water damage or freezing each year. (Source: Insurance Information Institute)

- The average residential home loses 14% of its water to leaks. In an average residence, 22 gallons of water are lost to leakage each day, and the most common culprits are leaking toilets or dripping faucets. This daily leakage volume is about equal to the amount of drinking water a family of 3 needs for 2 full weeks! (Source: www.leakdefensesystem.com)

- Beware! Mold can take a few days to appear. Mold thrives in a moist environment with organic material (e.g., paper or particle board), and temperatures between 68°F and 86°F. Keep air moving and maintain moderate temperatures as possible to prevent mold growth. (Source: www.iicrc.org)

- About one in 55 insured homes has a property damage claim caused by water damage or freezing each year. (Source: Insurance Information Institute)

-

BATHROOM

HIDDEN DAMAGE- Caution! Water damage can be deceptive. Water penetrates into structural cavities creating trapped pockets of saturation. The detection of water in these areas can often only be discovered with sophisticated moisture detection meters. Undetected moisture will continue to cause damage. This damage, at a minimum, will cause odors. Greater damage will surface when materials delaminate, shrink, split and further deteriorate to where costly repairs are required. (Source: www.iicrc.org)

- To prevent dry rot and on-going structural damage, don't reconstruct or cover wood materials until its moisture content falls below 16 percent. Moisture meters are available online, but it may be best to hire a water restoration professional to confirm proper drying before reconstruction. (Source: www.iicrc.org)

- Caution! Water damage can be deceptive. Water penetrates into structural cavities creating trapped pockets of saturation. The detection of water in these areas can often only be discovered with sophisticated moisture detection meters. Undetected moisture will continue to cause damage. This damage, at a minimum, will cause odors. Greater damage will surface when materials delaminate, shrink, split and further deteriorate to where costly repairs are required. (Source: www.iicrc.org)

-

FLOORING

WATER DAMAGE- In a high-risk area, your home is more likely to be damaged by flood than by fire. (Source: www.floodsmart.gov)

- Leaks can be slow and gradual, taking years to detect until significant property damage occurs, or there can be large leaks that quickly produce a variety of damaging results. (Source: www.leakdefensesystem.com)

- As the homeowner or renter, know what items to throw away! Porous items that absorb contaminated flood water shouldn't be restored. Drywall, carpet and pad, mattresses, pillows, box springs and particle board normally should be discarded if wet. (Source: www.iicrc.org)

- In a high-risk area, your home is more likely to be damaged by flood than by fire. (Source: www.floodsmart.gov)

SERVICES

We are here to provide you help !

Adjuster Licenses & Compliance

Most States require all Adjusters who handle claims in that State to be licensed in the Adjuster’s Resident State and comply with that State’s rules and regulations.

Confirm you are up to date on all necessary documentation and/or apply for all required licenses by going to your State’s Department of Financial Services, your State’s Department of Insurance, or NIPR.

If you need continuing education credits or assistance with obtaining an Adjuster license, please contact our office.

Training & Certification

Giles Insurance Adjusting is currently hosting Certification & Training classes. Please go to http://training.jimmiegiles.com to REGISTER for any one of our classes.

Don't see a class near you or unsure which class is best for you? Contact our office. We are here to help!

Weather Alerts

Whether you are an Adjuster, Business Owner, Homeowner, or Renter BE PREPARED!

Check out these links to assist you with weather safety & preparedness: